School Board Raising Millage Taxes

School District Says It's Not Their Fault, But Is That The Whole Story?

The Clay County School Board and School District are, once again, set to collect more taxes from residents of the county. The district and school board blame the state legislature. However, a source at the Florida Department of Education (FDOE) says that schools can choose to reduce their discretionary taxes and spending to offset state mandates.

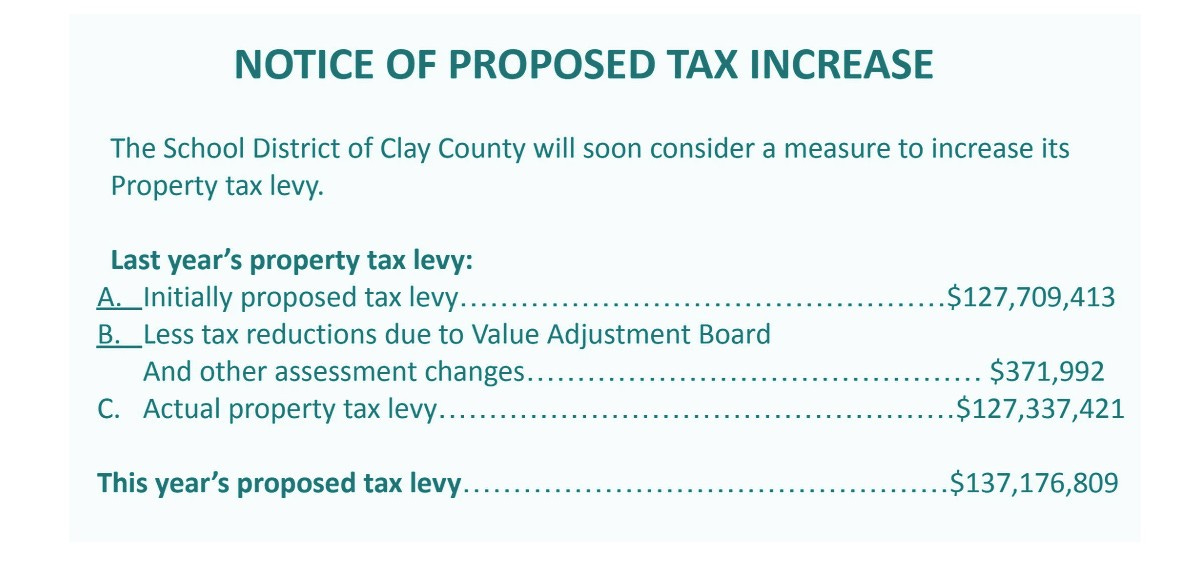

Over the course of the past few board meetings and workshops, District leadership composed, and the school board approved a tentative budget for the coming school year of $669 million. Included in this budget is a millage tax (also known as a property tax) increase, which is set to generate an additional $10 million for the district via taxes on property in Clay County.

Clay News & Views spoke with several school board members and Heather Posey, the new Assistant Superintendent of Business Affairs, about the tax increase. All of the people who spoke with Clay News & Views gave the same reasons for the increase in taxes: rising property values and a state law that mandates millage rates for local school districts.

In Florida, public schools are funded through a combination of state, local, and federal sources, with the largest share coming from the Florida Education Finance Program (FEFP). The FEFP is the state’s formula for allocating funds to school districts, which considers factors such as student enrollment, program costs (including special education or English language learners), and district cost-of-living differences.

The goal is to ensure that every student has access to a comparable level of funding regardless of where they live. While state general revenue and lottery funds play a major role, local property taxes also contribute substantially to the total funding picture.

A key component of local school funding in Florida is the Required Local Effort (RLE). Each year, the state sets a uniform millage rate that every school district must levy on local property values. This is not optional—it is mandated by state law to ensure that all districts contribute a fair, proportionate amount to their own education budgets. The RLE amount a district raises depends on its property tax base: wealthier districts may generate more dollars from the same millage rate, while districts with lower property values raise less. To balance this inequity, the state provides additional funds to districts with smaller tax bases so that all meet the minimum per-student funding levels established in the FEFP.

The RLE is the portion of local taxes being increased this year, and the portion that the school district blames for not being able to lower taxes.

Beyond the RLE, districts may also levy discretionary local millage (up to a capped amount set by the Legislature) and may seek voter approval for additional property taxes or sales taxes dedicated to education. These discretionary funds often support enhancements like teacher pay supplements, technology upgrades, and extracurricular programs.

Capital outlay millage, another local option, is typically used for facilities construction, repairs, and major equipment purchases. Federal funds—which make up the smallest share—are largely targeted to specific programs, such as Title I schools serving low-income students or special education services under IDEA.

Property tax increases due to inflation (via property values) have been another readily used tactic to sidestep questions about school district and county spending since the COVID-19 pandemic in 2020. Local officials with the authority to levy taxes are quick to tell citizens to “Call Tracy Drake” with any questions they have about increased taxes. Tracy Scott Drake has been the Property Appraiser in Clay County since 2020.

Property taxes and mandates from the state were the same narrative used by Posey’s predecessor, Dr. Susan Legutko, who retired earlier this year after a few heated exchanges about the transparency of the school district’s budget. The school board enacted a plan for an internal audit shortly before Legutko's retirement, as they sought greater transparency regarding the budget and spending.

While some of the school board members questioned Legutko’s practices to the point of calling for an internal audit, Posey’s performance has met with approval. You might wonder: What has Posey done differently than Legutko to garner such praise? The answer is not entirely clear.

Posey, though providing nearly the same information with the same narrative, is perceived by the School Board and district leadership as transparent and effective, unlike Legutko.

Meanwhile, the meeting details and results of the recently formed Internal Audit Committee remain unpublished.

After speaking with the Posey and board members, Clay News & Views contacted the Florida Department of Education (FDOE) and confirmed the local school districts are statutorily obligated to collect the full RLE to receive state education dollars.

The Department of Education went on to advise that school district budgets are not solely funded by the RLE and state dollars, as many school boards have enacted discretionary taxes via millages and sales taxes. These discretionary taxes can be lowered to offset an increase in the RLE, per the Department of Education.

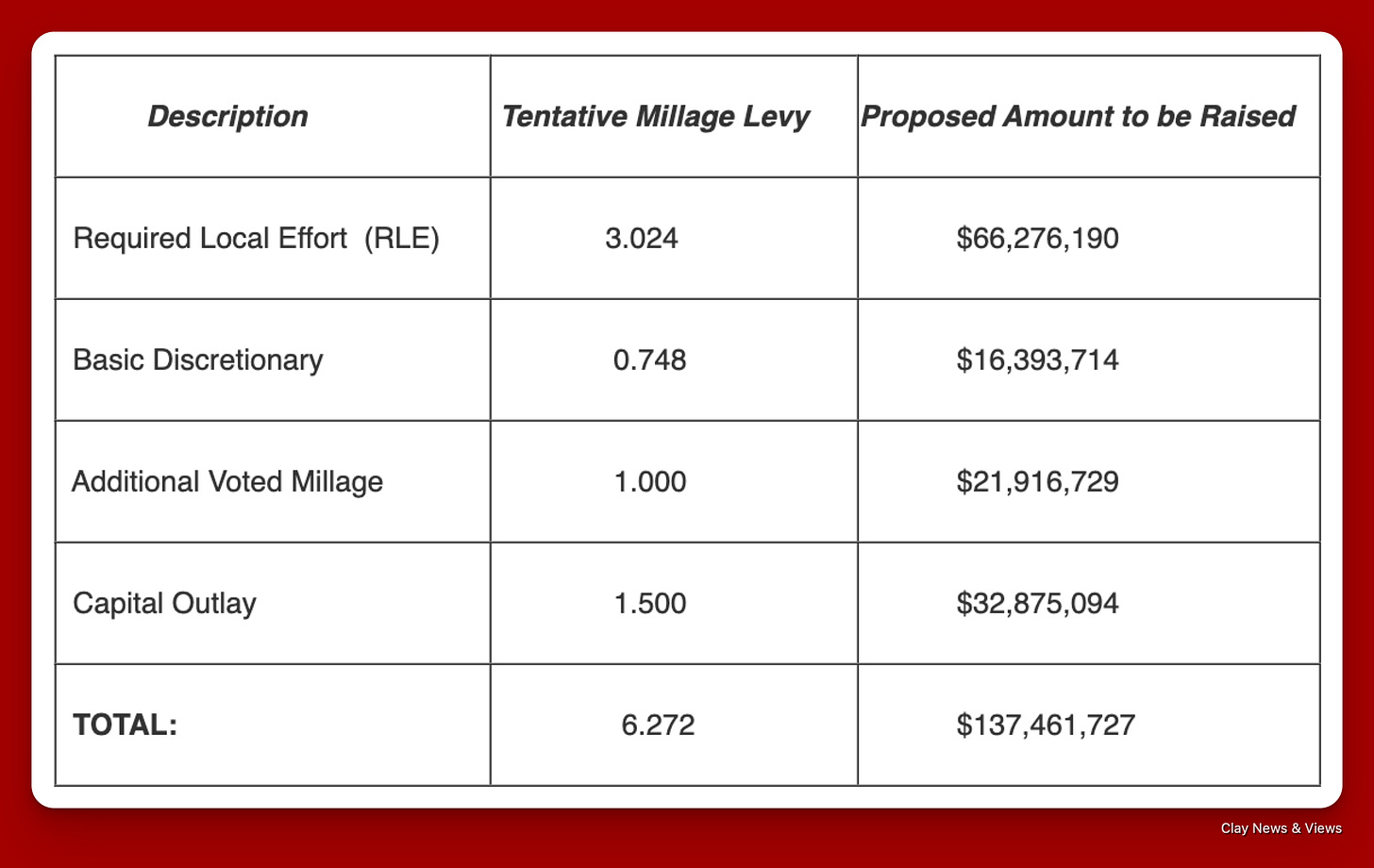

Clay County Schools has several funding streams that are discretionary, as seen in the screenshot below:

The RLE is 49% of the millage levied. The other 51% is discretionary. In this round of budget talks, the prospect of lowering discretionary spending to offset the mandated increase wasn’t brought up.

We know the school district can choose to spend less because, in June, the school district announced a $10 million shortfall, attributed to decreases in special funding and student enrollment not keeping pace with the county's overall growth. In response to this, the School district cut nearly $30 million in spending via reductions in district-level positions.

As retirees on a fixed income, we are being taxed out of our home. Something needs to give.