County Clarifies Budget Numbers

Spending Is Up, But By How Much?

*This article has been updated with additional details on the funding for the Green Cove Springs pickleball courts.*

Clay News & Views previously reported that the county's spending has increased by 169% since 2022. In response to our initial analysis, County Commissioner Burke and Assistant County Manager Troy Nagle invited CNV to a meeting to provide additional clarity and insight into the budget data.

Burke and Nagle noted that the numbers in our previous story included the total budget plus the cash reserves on hand. These cash reserves are used for projects that have been previously approved and earmarked, as well as to ensure that funds are available for unexpected expenses, such as hurricanes and natural disasters.

Looking at the year-over-year budget numbers alone, the county’s budget has increased from $399 million in 2022 to an estimated $571 million in 2026, representing a 43% rise.

While this is decidedly less than the rate if you include cash reserves, 43% is still more than triple the 12% inflation seen over the same time period. Burke and Nagle acknowledged the county’s budget has increased, but believe the funds are being used to address real needs in the county. They also stated that all county employees are expected to use funds as efficiently as possible.

Assistant County Manager Nagle also advised that the county is not giving $1.4 million to Green Cove Springs for their new pickleball court. The actual amount was $130,000 for the pickleball courts at the Augusta Savage Center, and the project was completed in 2024. Sorry, pickleball fans, guess you’ll need to start a GoFundMe campaign for any upgrades you were hoping for.

Commissioner Burke also wants more people to attend the County Commissioner meetings and speak their minds. The Board of County Commissioners (BCC) meetings start at 4 PM, but citizens don’t have to be present at the start to speak. There is a public comment section near the end of the meeting. Requests to speak to the board are sometimes accepted as late as 6:30 p.m., depending on the meeting's duration.

Much Ado About Millage Rates

The Board of County Commissioners' primary mechanism for collecting taxes is through the use of millage rates. A millage rate is a tax rate used to calculate property taxes, expressed as the amount of tax per $1,000 of a property’s assessed value. The term comes from the Latin word “millesimum,” meaning thousandth, as it represents a tax levy in “mills” (one mill equals $1 of tax per $1,000 of assessed value). These taxes are also referred to as Ad Valorem taxes, which is Latin for “according to value.”

The BCC’s levied millage rate has remained the same since 2022, at 8.601 mills. In 2026, the rate will increase slightly to 8.801 due to the Clay County Land Conservation Referendum. The referendum was approved by voters in 2024 and is expected to generate $4 million in 2026.

But the millage rate staying the same doesn’t mean the county isn’t collecting more money from residents. The rampant inflation resulting from COVID’s economic impact and an influx of new construction has led to the money collected from millage taxes jumping 54% over the course of five years. In 2022, the millage generated $108 million in taxes. In 2026, that number is expected to jump to $167 million after removing the land referendum dollars.

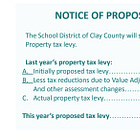

Florida statutes are designed to provide clarity to taxpayers regarding tax increases. Statute 200.065 requires local governments to provide transparency surrounding millage rates via the "Truth in Millage” or TRIM process. Part of this process is a concept known as the rollback rate.

The rollback rate is the millage rate that would generate the same amount of property tax revenue for a taxing authority as the previous year, excluding revenue from new construction, additions, or other allowed exemptions. It adjusts the millage rate downward to account for rising property values, ensuring that local governments don’t automatically collect more taxes due to market-driven increases in property assessments.

The process is supposed to keep local governments from blaming property values and property appraisers for the taxes they levy.

Local governments can choose to adopt the rollback rate each year and retain the same amount of dollars collected as in the previous year. If they choose a millage rate higher than the rollback rate, a public notice and public hearings are required to ensure the people paying the taxes are notified and able to provide input.

So though the BCC millage has remained at the same level each year, this means the county has chosen not to adopt the rollback rate. Which means they are choosing to collect more money from taxpayers each year. Ultimately, no one really cares about the tax rate; what matters is the dollar amount.

Commissioner Burke and her fellow board members have acknowledged that they are raising taxes, believing the money is needed for vital services. The same cannot be said for some of the other taxing authorities in the county.

They Need to show where all the money is going, who is getting it , the expenditures, and e plain why it is needed. Show all programs being bought and money to outside vendors and what it is for. Don’t tell each county department if you don’t use all your budget you get less next year . Budget correctly and let the save money and reward that department

Explain how and why the budget raised 54% in 5 years look at each budget and pay raises some 40,000 dollar raises why do we employ engineers but we sub contract mostly all engineering work toci etc how many millions are there contract they have employees work solely for clay county